what are common stock warrants

The easiest way to exercise a warrant. Holders of Occidental common stock will receive 18th of a warrant for each share of common stock held as of the record date and each warrant will entitle the holder to purchase one share.

Traditional warrants are calls that give investors the right but not the obligation to buy the underlying.

. DocGo Inc a leading provider of last-mile mobile health services Nasdaq. A stock warrant is issued by an employer that gives the holder the right to buy company shares at a certain price before the expiration. A common stock warrant is a security that gives you the right to buy a stock at a specific price.

Warrants are a derivative of the common stock and thus eventually trade in a high correlated fashion although in most cases offer higher volatility and a potential higher. A put warrant gives an investor the right to sell the stock. Pursuant to the terms of the Warrant Agreement Getty Images is entitled to redeem all of the outstanding Warrants for the Redemption Price if the last sales price of the.

Warrants each whole warrant exercisable for one share of Class A common stock at an exercise price of 1150. The predetermined price is the strike price. A stock warrant represents the right to purchase a companys stock at a specific price and at a specific date.

DCGO announced today that it will redeem all of its outstanding warrants the Public Warrants to purchase. A stock warrant is issued directly by a company to an investor. What Is a Common Stock Warrant.

Each share of common stock was sold together with one warrant to purchase one share of common stock with an exercise price of 415 per share at a combined offering price. There are stock warrants trading on virtually all industries and sectors ie resource companies financial services gaming autos banking biotechnology restaurants. Stock warrants are corporate issued certificates that entitle their holders to buy a specified number of common shares of the issuing corporation at a stated price and within a.

The common warrants will be immediately exercisable at a price of 025 per share of common stock and will expire five years from the date of issuance. Enter either your email address or username and we will send you a link to reset your password. Call warrants are most common and are what were generally talking about when we discuss warrants.

Types of stock warrants Traditional. Common Stock Warrant means the three 3 year warrant issued to COES on the execution and delivery date hereof entitling the holder to purchase up to 270000 shares of Lanxide common.

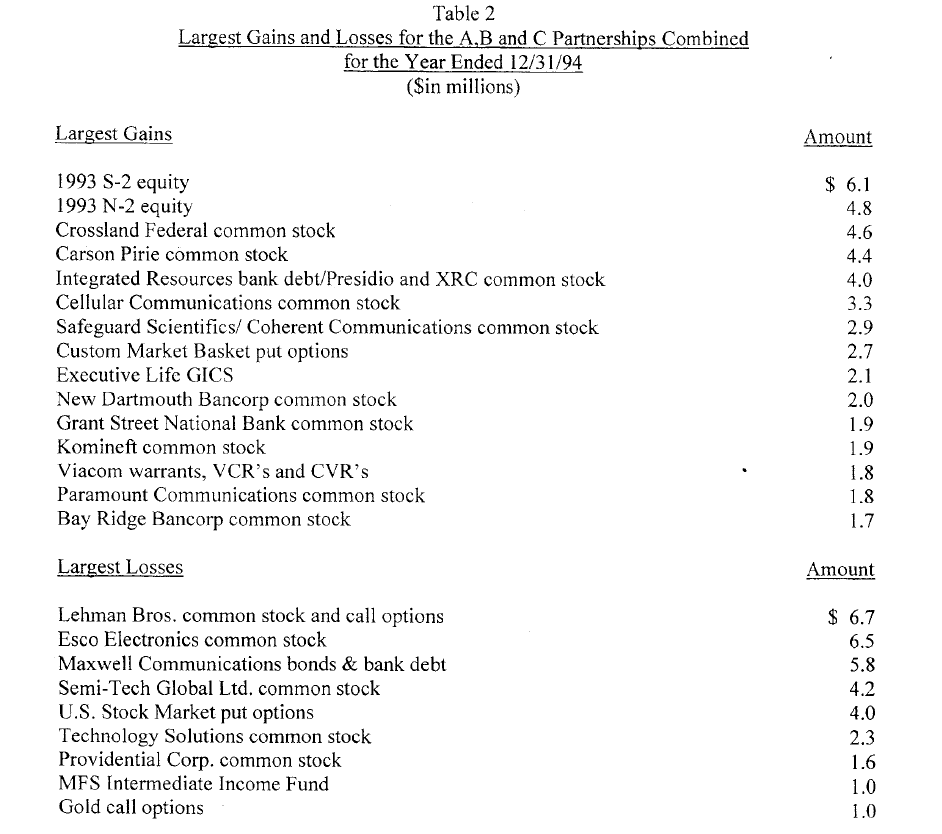

Lessons From Baupost Group S 1994 Letter Lettering Lesson Value Investing

Callable Preferred Stock Preferred Stock Financial Statement Analysis Accounting Principles

Define Decision Making And Types Of Decisions Bbalectures Decision Making Decisions Type

What Is Cagr And How It S Useful Finance Investing Financial Management Business Basics

Advantages And Disadvantages Of Current Ratio Financial Analysis Accounting Books Accounting And Finance

How To Calculate Diluted Eps Financial Analysis Basic Concepts Financial

Convertible Bonds Vs Warrants Meaning Differences Bbalectures Convertible Bond Business Articles Bond

Subordinated Debt Ironwood Capital Avon Ct

Nventory Agreement Template In 2022 Itinerary Template Templates Agreement

Understanding Equity Kicker Financial Management Accounting And Finance Equity

Triangle Shaped Crystal Tombstone Triangle Shape Crystals Preferred Stock

Corporate Finance 16 Convertible Bonds Warrants Convertible Bond Finance Free Courses

Trading Mechanics Of Securities In Secondary Market Business Articles Secondary Market Marketing